Zawartość

- Why the End of the Year Matters for Insurance Benefits

- Vein Symptoms Are Often Medical, Not Just Cosmetic

- Why People Put Off Vein Care, and Why Year End Is Different

- What Insurance Typically Covers

- What Happens If You Wait Until Next Year

- Why An Evaluation Now Can Help You Plan

- Często zadawane pytania

- When to Consider Scheduling an Evaluation

As the year comes to an end, many people begin reviewing holiday plans, travel schedules, and end-of-year to-do lists, but one important item is often overlooked: health insurance benefits.

For many insurance plans, deductibles and coverage limits reset at the start of the new year. That means waiting until January to address vein or vascular symptoms could result in higher out-of-pocket costs or delayed care.

If you’ve been experiencing leg pain, swelling, heaviness, or visible veins, the end of the year can be a smart time to take action, not because of pressure, but because your existing benefits may already be in place.

Why the End of the Year Matters for Insurance Benefits

Most health insurance plans operate on a calendar year. Once January arrives, deductibles often reset, and any progress you’ve made toward meeting them starts over.

If you’ve already met, or are close to meeting, your deductible, addressing medical concerns before year-end may help you make better use of your existing coverage.

Vein Symptoms Are Often Medical, Not Just Cosmetic

Many people delay vein care because they assume symptoms are cosmetic or not serious enough to address. However, conditions such as chronic venous insufficiency, varicose veins, and poor circulation are medical issues that can worsen over time if left untreated.

Common symptoms that may warrant evaluation include:

- Leg aching or heaviness

- Obrzęk nóg lub kostek

- Burning, throbbing, or cramping

- Swędzenie lub podrażnienie skóry

- Widoczne żylaki

- Skin discoloration or dryness

- Symptoms that worsen after standing or sitting

If these symptoms sound familiar, a medical evaluation can help determine whether treatment is appropriate and whether it may be covered by insurance.

Why People Put Off Vein Care, and Why Year End Is Different

It’s easy to postpone care when symptoms come and go. Busy schedules, travel plans, and uncertainty about insurance coverage often cause people to wait longer than they should before seeking evaluation.

The end of the year changes that conversation. Deductibles may already be partially or fully met, coverage details are already established, and waiting until January can mean starting over financially. Appointment availability can also become more limited as the year draws to a close. Scheduling an evaluation doesn’t mean committing to treatment, it simply gives you the information you need to make a confident, informed decision.

What Insurance Typically Covers

When vein conditions cause symptoms, not just appearance concerns, many insurance plans consider evaluation and treatment medically necessary.

Coverage may include:

Because coverage varies by plan, it’s always best to contact your insurance provider directly to verify benefits, understand deductibles, and ask questions about coverage before proceeding.

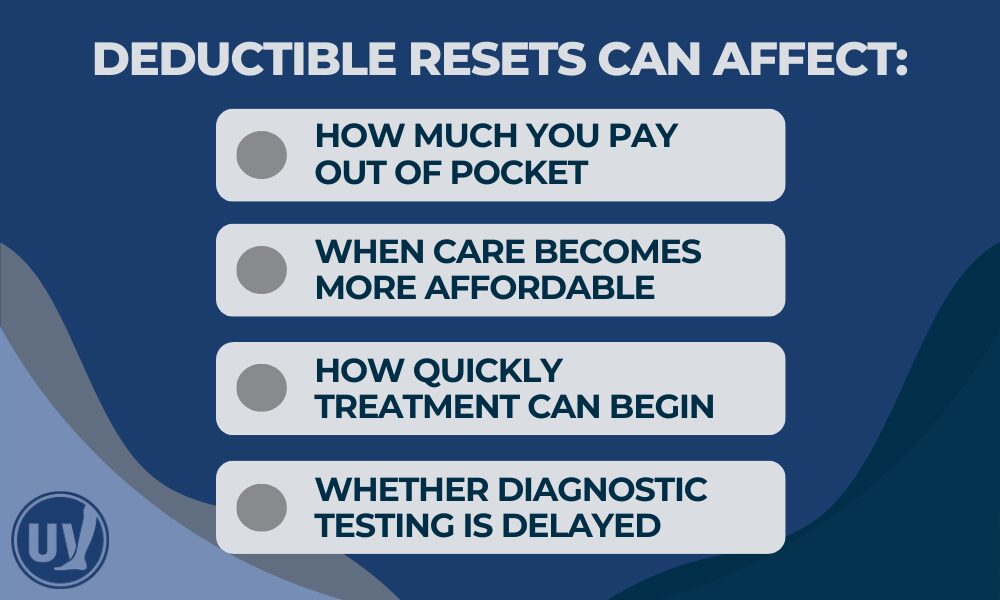

What Happens If You Wait Until Next Year

Waiting until January doesn’t mean you won’t be able to receive care, but it can change how that care is covered and when relief begins. For many patients, a new year brings a deductible reset, which may lead to higher out-of-pocket costs. Delaying evaluation can also mean living with symptoms longer, allowing discomfort, swelling, or heaviness to persist into the new year.

Because vein conditions are progressive, symptoms often worsen over time rather than improve on their own. Addressing concerns sooner can help prevent complications, provide earlier relief, and support better day-to-day comfort.

Why An Evaluation Now Can Help You Plan

Even if treatment doesn’t happen immediately, an evaluation before year-end can:

- Identify the cause of your symptoms

- Determine whether treatment is medically appropriate

- Help you understand potential timelines

- Allow you to discuss insurance questions proactively

Information gives you control whether you decide to move forward now or plan for the future.

Często zadawane pytania

Not necessarily. An evaluation helps determine your options. Some patients choose to move forward before year-end, while others use the information to plan ahead.

When symptoms are present, many plans cover medically necessary vein care. Coverage depends on your specific policy, so contacting your insurance provider is recommended.

Your insurance company can explain where you are in your deductible and what services may apply before it resets.

While not always urgent, vein disease is progressive. Symptoms often worsen over time, making early evaluation beneficial.

Most evaluations are completed in a single visit and include a consultation and physical exam.

Share This Reminder with Friends and Family

Many people don’t realize how insurance benefits reset each year, or that vein symptoms may be medically treatable. If you know someone who’s been putting off care, sharing this information may help them make a more informed decision before year-end.

When to Consider Scheduling an Evaluation

If you’ve noticed persistent leg discomfort, swelling, or visible veins, especially if symptoms worsen after standing, sitting, or travel, it may be time to seek care.

At United Vein & Vascular Centers, we provide comprehensive evaluations and personalized treatment planning in a comfortable outpatient setting. Our team can help guide next steps and encourage patients to verify insurance benefits directly with their provider.

Find a clinic near you and schedule your evaluation today.